Insurance Claims Recovery: Specialist Catastrophic Adjusters on Your Side

Wiki Article

Exactly How a Catastrophe Insurance Adjuster Can Optimize Your Insurance Insurance Claim

Navigating the complexities of an insurance coverage case complying with a calamity can be frustrating, particularly when attempting to ensure a fair settlement. A catastrophe adjuster possesses the proficiency to improve this process, providing useful understandings that can significantly improve your claim's outcome. From performing thorough evaluations to supporting for your civil liberties, their function is pivotal in reducing the tension related to claims management (insurance claims recovery). Nonetheless, comprehending the full scope of their capacities and just how they can work to your advantage is crucial-- there are essential aspects that can make all the difference in your claim experience.Comprehending Disaster Insurance Adjusters

Catastrophe insurance adjusters play a critical function in the insurance policy asserts procedure, specifically in the after-effects of considerable calamities. These experts specialize in evaluating damages arising from devastating events such as cyclones, fires, earthquakes, and floods. Their experience is vital for precisely evaluating the level of losses and determining ideal compensation for insurance holders.A catastrophe adjuster generally possesses specific training and experience in disaster-related cases, enabling them to browse the intricacies of insurance policy plans and regional regulations. They perform comprehensive assessments of damaged homes, compile thorough records, and gather supporting paperwork to confirm cases. This procedure commonly includes working carefully with insurance holders, specialists, and various other stakeholders to make sure a thorough assessment is finished.

In addition to assessing physical problems, catastrophe insurers additionally take into consideration the monetary and psychological impact on damaged individuals, using support throughout the cases procedure. Their objective point of view helps preserve fairness and openness, making certain that insurance holders obtain the advantages they are qualified to under their insurance plans - catastrophe claims. Recognizing the duty of disaster insurers is necessary for insurance holders seeking to optimize their insurance claims, as their knowledge can considerably affect the result of the insurance claims process

Advantages of Employing a Disaster Adjuster

Employing a catastrophe insurer can offer considerable advantages for policyholders navigating the cases process after a calamity. These specialists concentrate on analyzing damages from catastrophic occasions, making sure that the examination is precise and complete. Their expertise permits an extensive understanding of the intricacies involved in insurance cases, which can typically be frustrating for insurance policy holders.One of the key advantages of working with a disaster insurer is their capacity to make the most of claim settlements. Their knowledge of industry standards and techniques enables them to promote properly in behalf of the policyholder, ensuring that all qualified problems are documented and valued properly. This advocacy can bring about greater economic healing than what a policyholder could achieve on their own.

In addition, disaster adjusters bring neutrality to the insurance claims process. They are not emotionally invested in the after-effects of the calamity, allowing them to examine problems without bias. Their experience in working out with insurance companies can expedite the insurance claims procedure, reducing hold-ups that frequently occur when insurance policy holders manage cases individually.

Ultimately, engaging a disaster adjuster can alleviate the burden of browsing a facility insurance policy landscape, offering assurance during a difficult time.

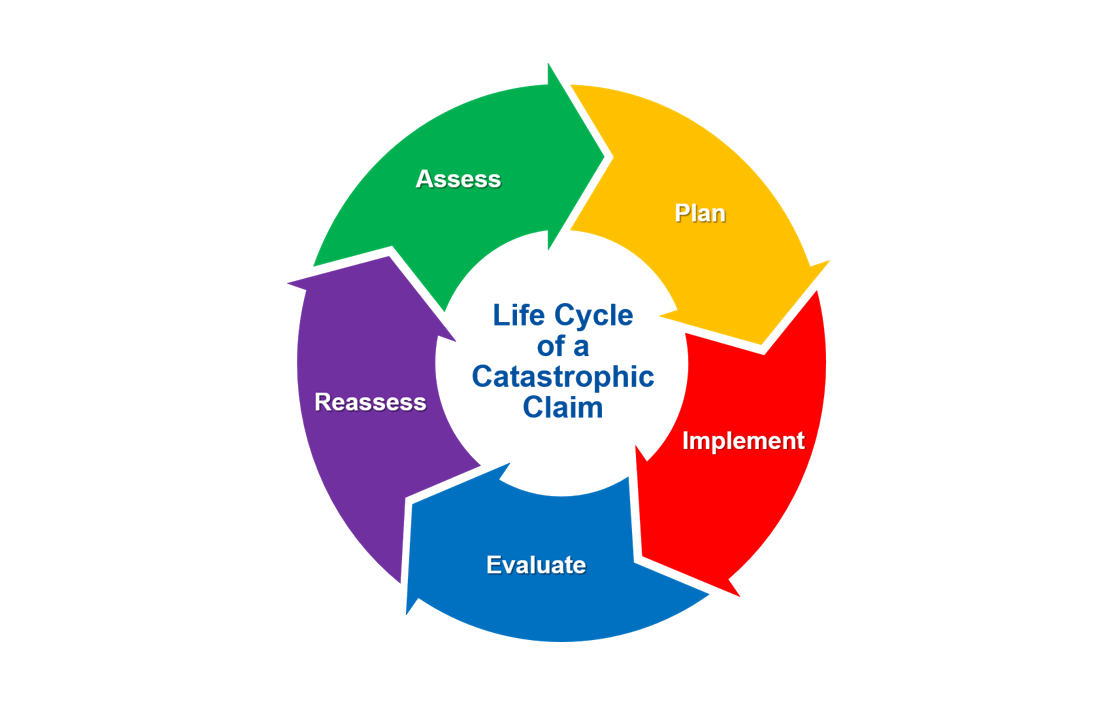

The Claims Process Clarified

After your insurance claim is submitted, an insurance coverage adjuster, commonly a disaster adjuster in extreme cases, will certainly be assigned to examine the damage. This expert will assess the degree of the loss, evaluate your plan for protection, and establish the proper settlement. It is important to document the damages thoroughly, including pictures and a comprehensive inventory of shed or harmed items.

The insurer article source will then examine the case and connect their decision regarding the payout. Throughout this process, maintaining clear interaction with your insurer and recognizing your policy will substantially improve your ability to navigate the cases process effectively.

Typical Mistakes to Prevent

Browsing the insurance coverage asserts procedure can be tough, and avoiding typical risks is crucial for optimizing your payout - catastrophic insurance adjuster. One widespread go to this website error is failing to record problems completely. Without appropriate proof, such as pictures and detailed descriptions, it ends up being tough to substantiate your case. Additionally, ignoring to maintain records of all interactions with your insurer can lead to misunderstandings and complications down the line.One more common error is taking too lightly the timeline for filing an insurance claim. Several policies have rigorous deadlines, and delays can result in rejection.

In addition, overlooking plan details can hinder your claim. Acquainting on your own with insurance coverage restrictions, exemptions, and particular demands is important. Finally, falling short to look for expert help can considerably affect the result. A disaster insurance adjuster can supply very useful assistance, making certain that you prevent these risks and navigate the claims procedure effectively. By recognizing and staying clear of these usual errors, you can substantially improve your possibilities of getting a fair and sufficient negotiation.

Choosing the Right Insurer

When it pertains to maximizing your insurance policy claim, picking the best insurer is an important action in the procedure. The insurance adjuster you pick can substantially affect the result of your claim, affecting both the speed of resolution and the amount you obtain.

Following, consider their online reputation. Look for evaluations or testimonies from previous customers to assess their dependability and effectiveness. A good adjuster needs to connect clearly and offer next regular updates on the progression of your case.

Final Thought

To conclude, engaging a catastrophe insurer can substantially improve the potential for a beneficial insurance case outcome. Their expertise in browsing complicated policies, performing complete evaluations, and effectively bargaining with insurance coverage companies makes certain that insurance policy holders receive reasonable compensation for their losses. By staying clear of typical pitfalls and leveraging the insurance adjuster's specialized knowledge, people can maximize their cases and ease the concerns linked with the insurance claims process, eventually leading to an extra adequate resolution in the consequences of a calamity.Catastrophe insurers play a vital function in the insurance claims procedure, especially in the after-effects of significant calamities. Understanding the duty of catastrophe insurance adjusters is important for insurance holders seeking to maximize their cases, as their competence can significantly influence the end result of the insurance claims procedure.

Their experience in negotiating with insurance policy business can speed up the cases process, decreasing hold-ups that often occur when policyholders take care of claims separately.

After your insurance claim is filed, an insurance insurer, often a catastrophe insurer in severe instances, will certainly be appointed to assess the damages. By preventing usual risks and leveraging the insurer's specialized expertise, individuals can optimize their claims and relieve the worries associated with the cases procedure, inevitably leading to a more acceptable resolution in the aftermath of a disaster.

Report this wiki page